The UK Budget 2024 has introduced a range of updates that will impact small to medium-sized businesses and make it crucial to adopt new practices as well as revisit financial projections.

While the highly anticipated UK Budget (also known as the Autumn Budget 2024) offers many areas of interest, the primary concerns for SMB owners revolve around three fundamental changes:

- Making Tax Digital (MTD) for Income Tax

- National Insurance Contributions (NICs)

- Payroll changes.

Each of these adjustments requires a significant shift in your cash flow forecast and we at Palmers would advise all SMB owners to get ahead of the changes sooner rather than later.

Here’s what you need to know.

Making Tax Digital (MTD): Preparing for New Income Tax Rules

The UK Budget 2024 outlines the upcoming MTD requirements for Income Tax, which will take effect in April 2026 for businesses with a combined income of over £50,000.

These requirements will eventually expand to cover smaller businesses, pushing all SMBs toward digital record-keeping systems.

Although designed to simplify tax compliance, MTD will likely require SMBs to adopt new software, such as Xero, and processes in order to adequately record and report business finances.

Particularly alongside the push to adopt e-invoicing in early 2025, business accounting for SMBs is undoubtedly moving towards a digital framework, from invoicing to record-keeping to tax submission. The early adopters will be best prepared for when digital is mandatory.

Palmers Tip: Preparing for MTD early can give you greater financial clarity, allowing you to track income and expenditures in real-time, whilst also adopting the time-saving automations that are on offer.

At Palmers Accounting we help you digitise your accounts to ensure a high level of time-saving automations, easy reporting and efficient communication. An established digital system streamlines your record-keeping and improves your cash flow management, ultimately supporting your profit and growth goals.

Increased NIC Contributions: Higher Costs for Employers

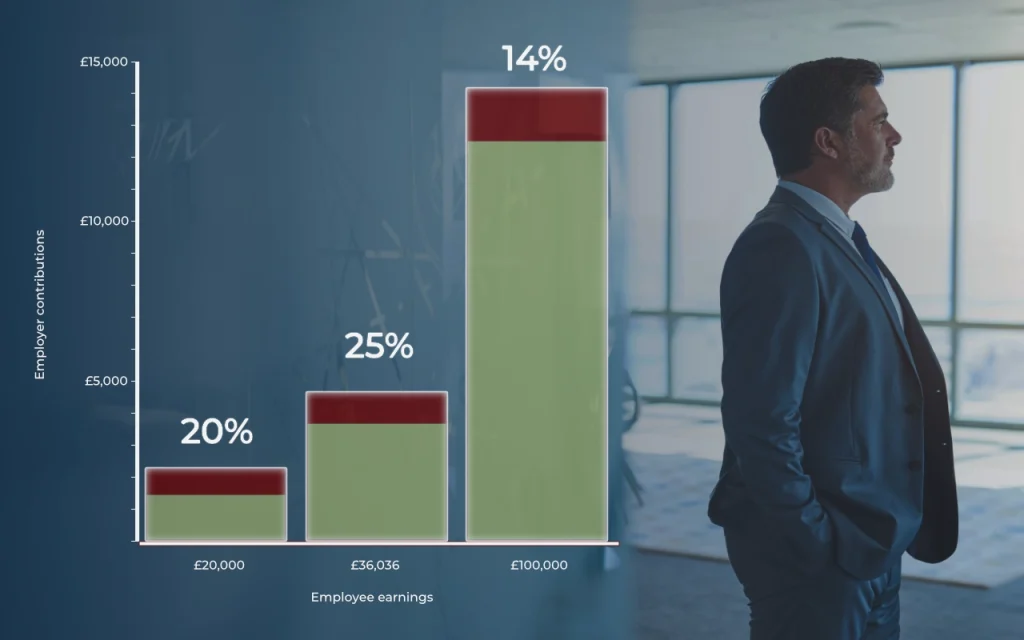

The Autumn Budget 2024 includes an increase in employer NICs from 13.8% to 15%, set to come into effect as soon as April 2025. The NIC Secondary threshold, which is the amount earned at which employers become liable for contributions, will be lowered from £9100 to £5,000, meaning that more businesses will be affected by this change.

For SMBs, higher NICs will directly impact payroll costs and may disrupt monthly cash flow.

However, in addition to these changes, the Employment Allowance, which is a deduction from the employer’s NIC bill, will increase from £5,000 to £10,500; the removal of the £100,000 threshold for eligibility is also coming into effect. These new numbers are quite a shake up to work into your Cash Flow Forecast.

Palmers Tip: At Palmers, we can assist in assessing how NIC increases will influence your payroll expenses. By analysing the changes introduced in the UK Budget, we’ll provide proactive methods to help you navigate rising employment costs and position your business for sustained profitability amid the new financial obligations.

Payroll Changes: Impact of National Living Wage Increases

The UK Budget 2024 also confirms that the National Living Wage will rise to £12.21 in April 2025, alongside similar increases in other minimum wage brackets. While this change supports employees, it also means higher payroll expenses for employers, which will undoubtedly impact the costs of running an effective team.

Palmers Tip: Palmers Accounting can work with you to examine the projected impact of wage increases on your business and specifically, your labour to sales ratios. With comprehensive cash flow assessments, we provide clarity on how wage adjustments may affect overall finances, helping you make informed decisions that keep your cash flow stable.

Time to Revisit Your Cash Flow Forecast

At the heart of effective business accounting, is an accurate Cash Flow Forecast.

With these key changes from the Autumn Budget 2024, updating your cash flow forecast has become essential; or if you have not yet created yours, we’d highly recommend you do so.

A proactive approach to cash flow will ensure your business is prepared for increased tax, payroll, and compliance costs.

At Palmers Accounting, we specialise in creating detailed cash flow forecasts that give you the confidence to make strategic business decisions, even amid regulatory changes.

Want to understand what a cash flow forecast is and why you need one? Read our blog post: Cash Flow Forecast: The Key to Sustainable Business Growth.

For more information on the latest policy changes, visit the official UK Budget 2024 page on the UK Government’s website or chat to one of our team.

Common questions about how the Autumn Budget 2024 will affect UK business

Will digital invoicing and business finances be mandatory?

Yes, under Making Tax Digital (MTD) initiatives, digital record-keeping and electronic invoicing will become mandatory for businesses meeting specific income thresholds. From April 2026, businesses earning over £50,000 annually must comply. Preparing early can help streamline your processes and ensure compliance.

Will my business be eligible for the Employment Allowance?

Yes, the Employment Allowance has increased to £10,500 from 2024, offering significant savings for eligible employers. Moreover, the previous restriction limiting eligibility to businesses with a National Insurance Contributions (NIC) bill of £100,000 or less has been removed. This change means the allowance is now accessible to all eligible employers, providing crucial relief against rising employment costs. For more details, visit the UK Government’s Employment Allowance page.

Do these changes make it more expensive to hire staff?

Yes. Using the UK average earnings of £36,036, the two combined factors will lead to an approximate 25% increase in the employer’s contributions. This percentage of increase is potentially more for low-wage staff.

How can I best prepare my business for MTD?

Businesses with an annual income over £50,000 will need to comply with MTD for Income Tax Self-Assessment from April 2026. Those earning between £30,000 and £50,000 have until April 2027. Knowing when your business must comply helps you plan accordingly.

Still, it’s best to get ahead of the game now, so ensure all financial records are digitised and organised, including invoices, expenses, and payroll details. Consistent record-keeping helps avoid last-minute errors. At Palmers, we digitise your finances whilst providing a leading strategy to increase your profits and growth; speak with one of our team for more information.

Where do I start in creating a cash flow forecast?

Read our article, which outlines the essentials of a Cash Flow Forecast. At Palmers, this is just one of the services we offer to ensure you are tax compliant and optimised, with accurate bookkeeping and projections. Have a chat with our team to learn more.